indiana inheritance tax exemptions

This item is available to borrow from 1 library branch. States have typically thought of these taxes as a way to increase their revenues.

Indiana Estate Tax Everything You Need To Know Smartasset

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

. Indiana Inheritance Tax Exemptions and Rates. INHERITANCE TAX EXEMPTIONS AND DEDUCTIONS IC 6-41-3 Chapter 3. For more information please join us for an upcoming FREE seminar.

The exemption is 117 million for 2021 Even then youre only taxed for the portion that exceeds the exemption. No tax has to be paid. The other 250000 inherited by each child would incur a tax of 7250.

For example three siblings inheriting a 1 million parcel of land from a family friend had an. Each heir or beneficiary of a decedents estate is divided into three classes. List in the appropriate column the age of each transferee the value of property transferred the exemption and the amount of the transfer subject to tax.

This means without an Indiana inheritance tax Indiana estates have to be greater than 525 million before any state or federal death taxes would be due. However many states realize that citizens can avoid these taxes by simply moving to another state. Ie the total value of interest minus the applicable exemption by the appropriate tax rate.

A spouse widow or widower of a stepchild fell into this category prior to SEA 293. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are required for those dying after December 31 2012. Class A Beneficiaries Exemptions effective 070197.

What is the estate tax exemption for 2021. As added by Acts 1976 PL18 SEC1. If the decedent died testate list the section of the will applicable to each testamentary transfer.

Each inherits 500000. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. This exemption was not changed by SEA 293.

However that phase out was accelerated dramatically when the Indiana legislature enacted and Governor Pence signed into law on May 8 2013 the repeal of Indianas Inheritance Tax. If the person died in 2014 the law applies a 20 credit against the tax 1450 and. The inheritance tax rates are Class A Net Taxable Value Of Property Interests Transferred Inheritance Tax 25000 or less 1 of net taxable value Over 25000 but not over 50000 250 plus 2 of net taxable value over 25000 Over 50000 but not.

Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. If you have additional questions or concerns about estate planning and taxes contact an experienced Indianapolis estate planning attorney at Frank Kraft by calling 317 684-1100 to schedule an appointment. Spouse Children Grandchildren Parents Effective July 1 1997 the first 10000000 of an estate going to an heir.

2006 Indiana Code - CHAPTER 3. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. But just because the inheritance taxes didnt change in 2020 doesnt mean state legislatures wont change them going forward.

Inheritance Tax Exemptions and Deductions. With the estate tax exemption limit currently set at almost five and a half million dollars many Indianapolis residents might have the impression that estate planning is no longer as important as it once was. The item Inheritance tax.

The amount of each beneficiarys exemption is determined by the relationship of that beneficiary to the decedent. Learn How an Estate Planning Attorney Can Help You Avoid Common Mistakes. Indiana does not have an inheritance tax nor does it have a gift tax.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Code 6-41-3-10 through 6-41-3-12 for specific exemption amounts. Amended by Acts 1976 PL19 SEC1.

In 2013 there would be a 10 credit against this tax which is 725 and thus the actual tax owing for each child would be 6525. Ad Download Or Email Form ST-105 More Fillable Forms Register and Subscribe Now. Indiana inheritance tax was eliminated as of January 1 2013.

Total Value of PRoPeRty tRanSfeRReD name address. 2021 Estate Tax Exemption For people who pass away in 2021 the exemption amount will be 117 million. If real estate is included in the property subject to taxable transfers by Decedent the affidavit may be recorded in the office of the county recorder.

Each class is entitled to a specific exemption IC6-41-3-91. As added by Acts 1976 PL18 SEC1. Class B beneficiaries are given a 500 exemption before any tax is due.

Allowable exemptions are unlimited for Decedents surviving spouse and for qualified charitable entities. Class C beneficiaries includes all beneficiaries who do not fit within the Class A or B definitions. Last year the Indiana legislature enacted a plan to phase out Indianas Inheritance Tax by the end of year 2021.

Inheritance tax was repealed for individuals dying after Dec. That repeal is effective retroactively to January 1 2013. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are.

No tax has to be paid. Each transfer described in section 2055a of the Internal Revenue Code is exempt from the inheritance tax. As a result Indiana residents will.

IC 6-41-3-65 Annuity payments. The first 250000 for each child would be exempt. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

Inheritance tax Law IC. An Overview of Indiana Inheritance Laws. Class C beneficiaries had only a 100 exemption and the tax rates ranged from 10 to a 20.

The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million. Class C beneficiaries are given a 100 exemption before any tax is. How much money can you inherit without paying inheritance tax.

Child stepchild parent grandparent grandchild and other lineal ancestor or descendant. Miscellaneous taxes and exemptions represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021.

The proceeds from life insurance on the life of a decedent are exempt from the inheritance tax imposed as a result of his death unless the proceeds become subject to distribution as part of his estate and subject to claims against his estate.

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Funny Security Staff Sleeping Sleep Deprivation Sleep Funny

States With No Estate Tax Or Inheritance Tax Plan Where You Die

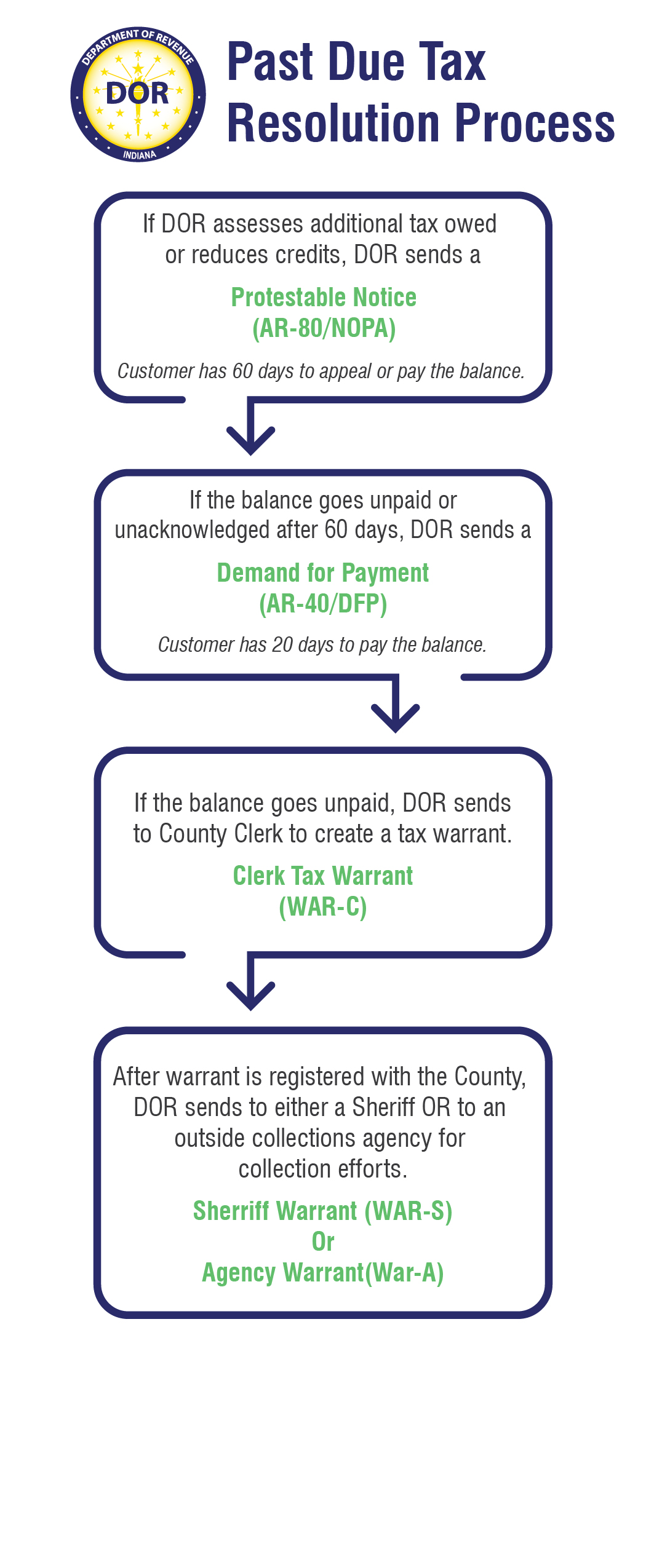

Dor Make Estimated Tax Payments Electronically

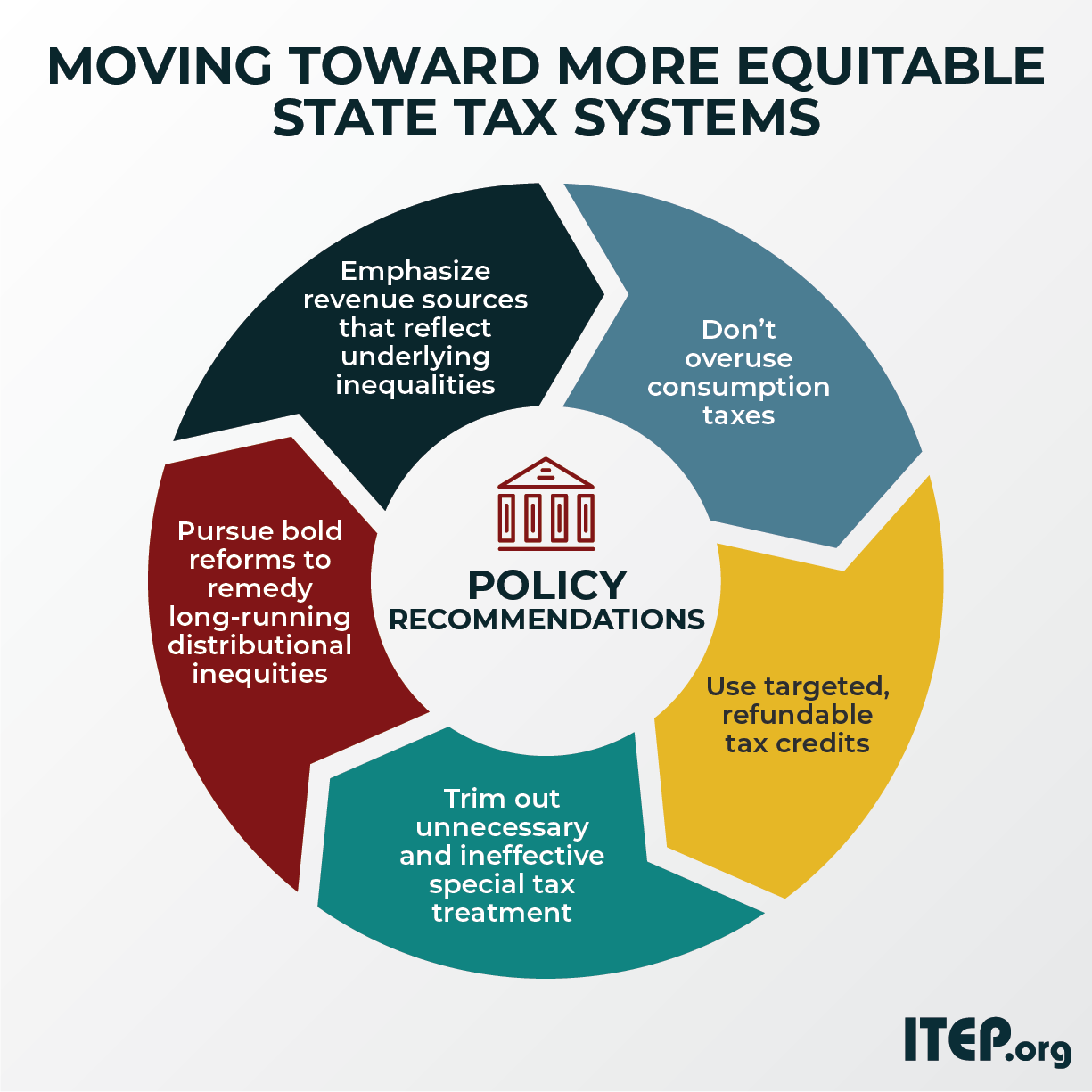

Moving Toward More Equitable State Tax Systems Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Investment Banker Resume Example Resume Examples Job Resume Samples Good Resume Examples

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

States With Highest And Lowest Sales Tax Rates

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Indiana Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Indiana Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center